A responsible and sustainable financier

The aspects of Finnvera’s sustainability are environmental and social responsibility, good governance, financial responsibility and risk management. In particular, efforts and goals to mitigate climate change have been highlighted as part of Finnvera’s strategy.

Finnvera's most significant environmental and climate impacts arise from export financing projects. Emission-intensive industries that also consume a large volume of natural resources predominate in Finnish exports. On the other hand, Finnish state-of-the-art technology can also help reduce the environmental load of projects.

Climate target and measures to mitigate climate change

In our climate strategy, the measures are grouped into six areas: encouraging, measuring, managing risks, limiting, influencing and competence.

Measures and goals

Finnvera's Carbon footprint

Finnvera has set itself the strategic objective of introducing more detailed identification, measurement and reporting of the climate impacts of its financing operations. The development of the emission calculations continued in 2024, and Finnvera was able to collect more data concerning individual companies and projects. The more detailed data indicated that Finnvera's emissions from financing operations decreased by 15% compared to the previously reported. The calculation is based on 2023 data.

- Finnvera's carbon footprint in total was 4.9 Mt CO2 e. Majority of the carbon footprint came from the financed projects.

- Emissions from Finnvera's own operations were 1,339 tCO2e.

Finnvera calculated carbon handprint, in other words avoided emissions, for the first time.

- Finnvera's carbon handprint was 0.2 Mt CO2e

| Finnvera's carbon footprint 2021–2023, t CO2e | 2021 | 2022* | 2023 | Change % |

| Scope 1, Fuels | 80 | 42 | 61 | 43% |

| Scope 2, Electricity, district heating and cooling´(market-based coefficient) | 359 | 153 | 151 | -1% |

| Scope 3 | 9,042,275 | 5,739,928 | 4,884,505 | -15% |

| Category 1: Purchased Goods and Services | 83 | 35 | 276 | 698% |

| Category 2: Capital Goods | 0 | 23 | 52 | 123% |

| Category 3: Fuel production and energy transmission losses | 22 | 40 | 58 | 43% |

| Category 5: Waste management | 47 | 7 | 6 | -10% |

| Category 6: Business Travel | 25 | 275 | 674 | 145% |

| Category 7: Employee commuting | 21 | 64 | 62 | -3% |

| Category 15: Financed emissions | 9,042,077 | 5,739,485 | 4,883,378 | -15% |

| Carbon footprint in total | 9,042,714 | 5,740,228 | 4,884,833 | -15% |

| *The carbon footprint calculation for 2022 has been revised in connection with the calculation for 2023. | ||||

Based on the emission calculations, Finnvera developed its long-term emission pathways in 2024. The emission pathways will be used to measure Finnvera’s climate change mitigation measures and assess their compatibility with the Paris Agreement.

Around one half of Finnvera’s outstanding commitments relate to ship financing. Finnvera calculated the emissions from this sector for the third time in keeping with the Poseidon Principles initiative.

Of the exposure for export financing related to energy production, the shares of renewable and fossil energy are monitored.

Social responsibility at Finnvera

Competent personnel are a key success factor for Finnvera's work. Finnvera makes inputs in developing the professional skills and wellbeing of our personnel in many ways, and our HR management is based on an open reward scheme, systematic competence management and taking care of our employer image.

In addition to our own employees, issues related to the working conditions and terms of employment of workers in projects we finance play an important role in Finnvera’s social responsibility. This is why assessing the social impacts and risks of the projects is an important part of financing decisions. The UN Guiding Principles on Business and Human Rights (UNGP), IFC’s Performance Standards on Environmental and Social Sustainability, and any other requirements imposed by Finnvera are taken into account when assessing financing projects.

Financial responsibility and risk management

One of the cornerstones of our operations is a long-term self-sustainability, which we ensure through controlled risk-taking.

We develop and enhance risk management and risk transfer methods for large exposure and risk concentrations. We are constantly developing risk management methods to meet the changed requirements of the operating environment.

We are integrating climate change risks into our key financing decisions and risk management.

With Finnvera's ISO 9001 certified operating system, we ensure comprehensive quality control.

Sustainable Investment Principles

For the improvement of sustainability and corporate responsibility, Finnvera introduced a framework for sustainable investments in treasury investments. The goal for the investment operations of Finnvera’s Asset Management in 2024 was that 15% to 20% of long-term investments are thematic investments that meet the Asset Management’s ESG criteria. This goal was exceeded and, at the end of 2024, 24% of long-term investments were thematic investments meeting the ESG criteria. Slightly less than two thirds of them were green bonds.

Thematic investments will be continued within the framework of the company’s risk-taking policy and investment plan. The planned share of thematic investments for year 2025 is 25% to 30% of long-term investments.

Take a look at Finnvera's principles for sustainable investment.

Impact and sustainability

Sustainability and impact are interlinked in Finnvera's strategy. Sustainability is the basis and impact the spearhead of the strategy. It means that our financing helps clients generate and obtain turnover, financial profit and jobs that would not have been possible otherwise. We seek new ways to measure impact better.

Finnvera has an important social role in facilitating and augmenting Finnish enterprise activities. Through export solutions, Finnvera also contributes to the exports of Finnish know-how abroad.

Finnvera's most significant environmental and climate impacts arise from export financing projects. Emission-intensive industries that also consume a large volume of natural resources predominate in Finnish exports. On the other hand, Finnish state-of-the-art technology can also help reduce the environmental load of projects.

Good governance and sustainability management

Good corporate governance and risk management are highlighted in Finnvera's strategy. The Finnvera Group strives to ensure transparency at all levels of the organisation. Finnvera implements its mission and strategy in accordance with the laws, regulations, and industrial policy goals guiding the company’s operations.

Finnvera has a Code of Conduct that covers the main principles and practices of good conduct. At Finnvera, implementation of sustainability is monitored by the Management Group. Responsibility for this is vested in the Board of Directors and the CEO. Management of sustainability is also defined in Code of Conduct.

In export financing operations, we follow international rules on export financing and are actively involved in international development and cooperation. We comply with international principles and recommendations related to corporate responsibility, and Finnvera has its own Environmental and social risk management policy.

The most important policies related to Finnvera’s financing operations can be found at the Code of Conduct -page.

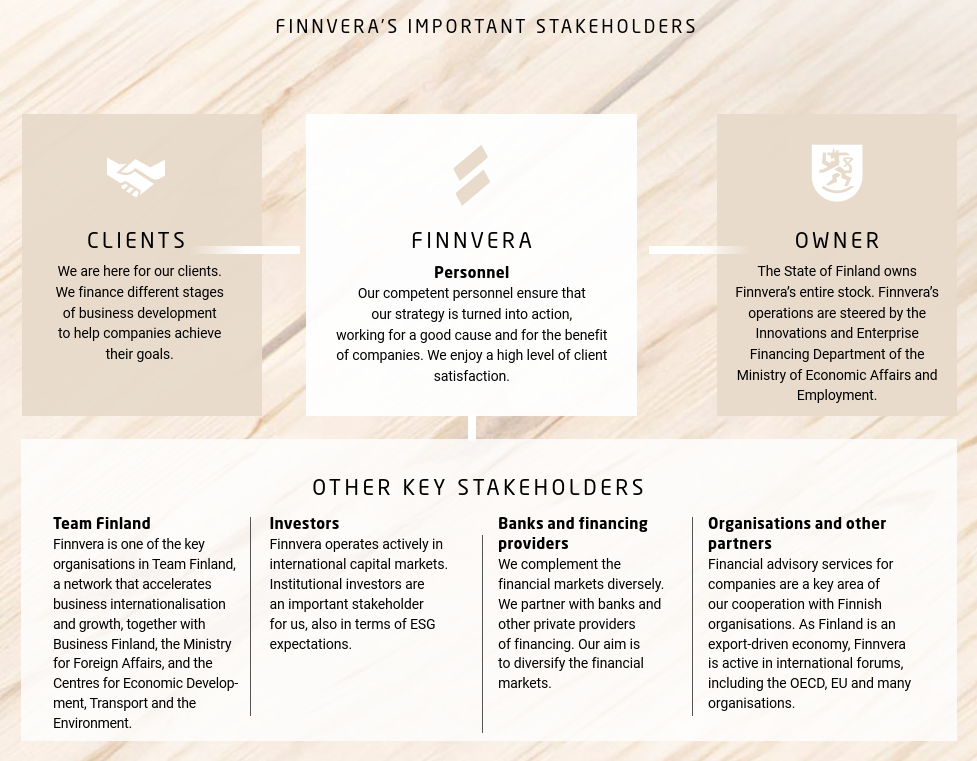

Stakeholders

Finnvera’s network of stakeholders is wide. Finnvera has identified the following as its most important stakeholders: clients, banks and cooperation partners, Team Finland organisations, domestic and international organisations, personnel, state owner and investors.

We keep a close eye on similar organisations in other countries and develop our financial services in step with the changing needs of Finnish companies.

The EU Corporate Sustainability Reporting Directive (CSRD) does not apply to Finnvera under national legislation. Despite this, the company has sought to improve its CSRD reporting capabilities step by step as Finnvera's stakeholders, including clients and banks, will be within the scope of EU sustainability reporting in the next few years.

In 2023, Finnvera carried out a materiality assessment in keeping with the double materiality principle laid down in the CSRD for the first time. The sustainability themes prioritised as a result of the analysis will lay the foundation for Finnvera's sustainability reporting from 2024 onwards.