Benefits of the export credit

Export credit benefits both the export and the buyer.

Benefits for the exporter

- An asset in trade negotiations – possibility to offer finance for the buyer

- Export credit does not burden the exporter's balance sheet

Benefits for the buyer

- Long repayment period

- The new source of financing allows the buyer to expand its financing base

For whom

Export credit can be granted to a creditworthy foreign buyer. The security and/or need for a guarantor is assessed on a case-by-case basis according to the credit risk.

See the list of countries to which the export credit can be granted. If the buyer (borrower) is located in a country outside the list, the eligibility of the country is determined on a case-by-case basis based on exporter's inquiry.

Preconditions for Export credit

- The maximum credit amount is EUR 20 million.

- The maximum credit amount can be up to EUR 40 million to projects that meet Finnvera’s sector-specific climate criteria. In these cases we first find out whether your bank can grant the credit you need with the help of Finnvera’s export credit guarantees.

- The maturity of the credit is at least 2 years.

- Credit currencies are EUR, USD or, on a case-by-case basis, the borrower’s or buyer’s country’s currency

- Floating or fixed rate credit are available

- Export transactions must have a sufficient Finnish content

- The buyer must pay to the exporter an advance payment of at least 15%, typically before the first drawdown of the credit

- The credit is typically repaid in equal and semi-annual instalments

- The credit is subject to the terms of the OECD Arrangement

Export credit to the buyer is a credit jointly offered by Finnvera and Finnish Export Credit Ltd (a 100% owned subsidiary of Finnvera). Finnish Export Credit Ltd acts as a lender and Finnvera as an agent. A precondition for granting the credit is Finnvera's export guarantee.

The exporter applies for the export credit to its buyer and provides information on the export transaction.

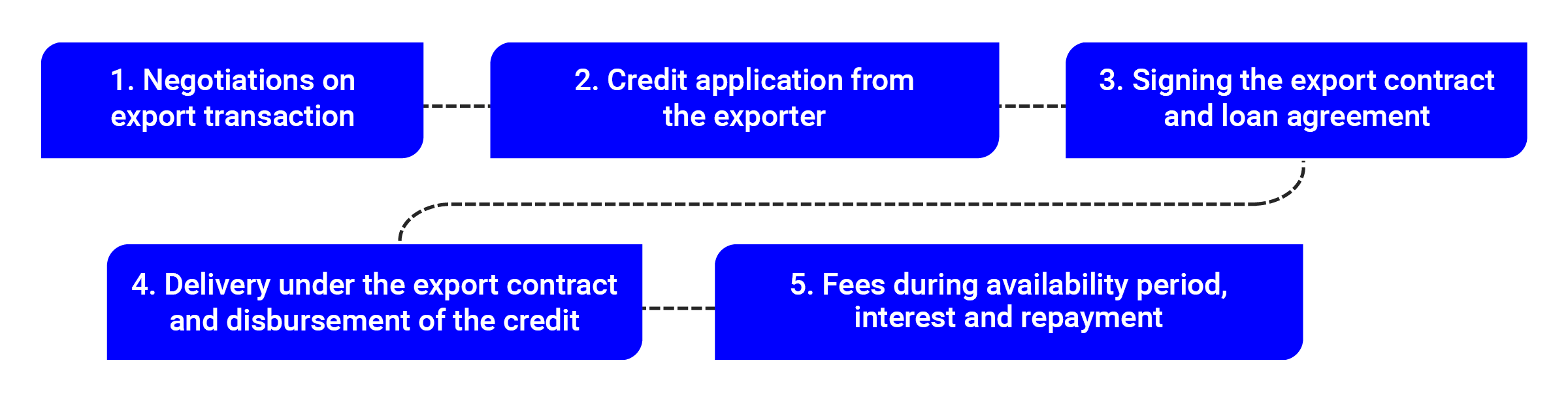

Stages of the process

Costs

Exporter's costs:

- Handling fee (incl. credit report) EUR 300 – EUR 1,300 depending on the amount of the credit

Buyer's, i.e. the borrower's, costs:

- Arrangement fee that is invoiced at the time of signing the loan agreement

- Commitment fee for the unutilised part of the credit that is invoiced every calendar quarter

- Margin in accordance with the borrower's risk rating + floating or fixed interest rate

- Law firm fees and any other costs arising from the credit

Exporter's risks

When negotiating the terms and methods of payment, the exporter must take into account that the export credit granted to the buyer does not serve as guarantee for payment, unlike, for example, documentary credit. Therefore, the exporter must ensure that the risks during manufacturing period and the risks related to its receivables are covered by, for example, a documentary credit, bank guarantee, credit insurance e.g. Finnvera's credit risk guarantee. To understand the risks, the exporter must note that disbursements under the credit can only be paid to the exporter if:

- the credit agreement is effective (For example the borrower complies with all the terms of the credit agreement) and

- The borrower makes a disbursement request in accordance with the credit terms.

Possible exchange rate risk of the borrower

The export credit is granted in euros (EUR) or dollars (USD), and repayment instalments, interest and fees must also be paid in the currency of the credit. If the borrower's income is mainly in a different currency than the export credit, the borrower should consider if there is a need for hedging the exchange rate risk. The possibility of hedging can be discussed, for example, with the borrower’s own bank.