The Finnvera Group’s Interim Report for January-June 2015

An eventful start of the year for Finnvera

Finnvera’s mandates and tasks have expanded on several occasions during last year and the current year. In the period under review, it became possible for Finnvera to guarantee the refinancing of export credits granted by banks. This arrangement promotes the acquisition of funds for financing exports.

A new guarantee, known as the Start Guarantee, was taken into use in April. It is intended for the financing of starting enterprises that have been in business for no more than three years. Demand for the guarantee, which is given for a loan granted by a bank, has been brisk. Within three months, over 400 enterprises have been granted these guarantees, for a total sum of almost EUR 20 million. Improvements to the provision of financing have been implemented in all enterprise size categories. Since the beginning of this year, when certain conditions are met, Finnvera has been able to provide a growth enterprise a loan of at most EUR 2 million without collateral in order to finance growth.

In line with the Government Programme public actors are still given the task of offsetting shortcomings that exist in enterprise financing on the commercial market. During the summer and early autumn, Finnvera will work under the Ministry of Employment and the Economy to prepare new measures for implementing the Government Programme.

Business operations and the financial trend

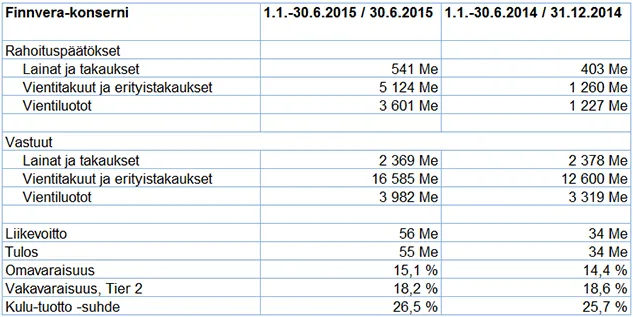

During the first half of the year, the volume of export credit guarantee offers given by Finnvera was over four times greater than in the first six months of 2014. As concerns financing offers for export credits, the figure was nearly three times greater. The volume of loans and guarantees granted to SMEs and enterprises larger than the SME definition applied by the EU was 34 per cent greater than the year before.

The Finnvera Group’s profit for January–June came to EUR 55 million (34 million). This was EUR 20 million more than for the first six months of 2014. The main factors improving the financial performance were the decreases in impairment losses on receivables and guarantee losses, as well as the increase in the fee and commission income of the parent company, Finnvera plc.

The profit of the parent company, Finnvera plc, stood at EUR 56 million (40 million). The Group companies and associated companies had an effect of EUR -1 million on the profit (-5 million). Venture capital investments accounted for EUR -6 million of this effect (-7 million). Interest equalisation and the financing of export credits by Finnish Export Credit Ltd accounted for EUR 5 million (1 million).

The parent company’s export financing and SME financing showed a profit: the separate result for export credit guarantees and special guarantees came to EUR 46 million (31 million), while the profit for loans and guarantees in SME financing was EUR 10 million (4 million).

In accordance with IAS 8 standard, an adjustment affecting the previous financial periods has been made in the Finnvera Group’s financial statements for January–June 2015. Owing to a system error in the accrual of income from export credit guarantees and expenses from reinsurance, the sums recognised on the income statement had been too small. Correspondingly, the sums for guarantee premiums and reinsurance premiums paid in advance and shown on the balance sheet had been too large. The adjustment had an effect of EUR 53 million on the equity attributable to the parent company on the balance sheet as per 31 December 2014 and 30 June 2015. The effect on the net value of fee and commission income and expenses for the reference period 1 January–30 June 2014 was EUR 43 thousand (Notes to the accounts 1).

ezembed

Outlook for demand for financing

During the first half of 2015, demand for Finnvera’s SME financing was considerably livelier than it was a year ago. The value of the applications increased by 44 per cent. Above all, the growth was attributable to Finnvera’s wider mandates, such as the possibility to finance enterprises larger than SMEs and to subscribe bonds. The SME financing volume is also expected to remain on high level during the latter half of the year.

Individual large projects increased the demand for export financing, which was more than triple the figure for the corresponding period the year before. Demand for export credit guarantees is expected to remain brisk in Finland. However, the worldwide demand for guarantees has shown signs of decline in many countries because banks have increasingly often started once again to provide financing for large export transactions and, on the other hand, because investments have been falling, especially in the energy sector.

CEO Pauli Heikkilä:

'“For us, the first six months of the year were busy as concerns both demand for financing and the granting of financing. Thanks to our ever wider range of financing opportunities, we were able to participate in many financial arrangements. For instance, we completed our first bond subscription during the period under review. Our anchor role ensured that financing could be arranged for the total investment of over 100 million euros by Kotkamills. We are also participating in the financial arrangements for the bioproduct mill to be constructed in Äänekoski by Metsä Group. To facilitate equipment purchases from Finland, we provide guarantees for about half, or 400 million euros, of the debt needed for the project. Apart from Finnvera, six commercial banks, the Swedish Export Credits Guarantee Board (EKN) and the European Investment Bank are participating in the arrangements.”

Additional information:

Pauli Heikkilä, CEO, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finance and IT, tel. +358 29 460 2458