The Finnvera Group's Interim Report for January-September 2013

Financing is available – demand is weak

Bank financing in Finland is still functioning reasonably well, but bank collateral and self-financing requirements and financing prices have increased. The demand for financing by SMEs was still affected by a lack of investments. Although in Finnvera there was a great deal done in working capital financing and the restructuring of previous financing arrangements, euro-currency demand was weak. The overall decline in Finnish exports was not felt in the demand for export financing, which was greater than the demand for the same period in the previous year.

Business operations and financial trend

The value of financing offers given to SMEs in January-September dropped 12 per cent from the same period in the previous year. More financing applications involving exports were received than in the previous year, but the number of offers given was nearly 10 per cent lower. Credit agreements for some of the applications were still under negotiation.

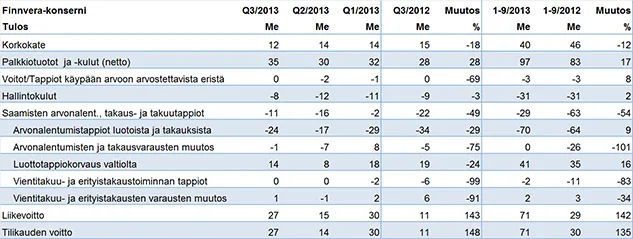

The Finnvera Group’s profit was EUR 71 million, which is significantly better than for the same period in the previous year (30 million). This improvement in the Group's profit was mostly due to an increase in the parent company's (Finnvera plc) fee and commission income as well as a decrease in the net impairment loss on financial assets. Correspondingly, the improvement in profit was reduced by a decline in net interest income.

In the parent company Finnvera plc both export financing and SME financing showed a profit: The profit for export financing was EUR 63 million (45 million) and for domestic credits and guarantees EUR 11 million (-10 million). The subsidiaries and associated companies had an impact of EUR -3 million on the Group's profit (-4).

The group’s key figures on 30 September 2013 (30 September 2012)

- Capital adequacy 17.3% (15.8)

- Cost/income ratio 25.1% (27.6)

- Equity ratio 19.3% (23.4).

Outlooks

Uncertainty in the global economy is dampening the desire to invest, make growth plans and take risks. This can be seen in the modest demand for SME financing. Public debate, particularly that concerning the poor availability of SME financing, further increases the feeling among businesses that investment conditions are less than ideal. Ensuring the financing of financially viable projects is Finnvera's primary task, something which is carried out effectively even in an economically challenging time.

The outlook for an industry concentrated on the export of Finnish capital goods remains dim. The demand for Finnvera’s export credit guarantees and credits will, however, stay at the currently high level, because, just as is done in competing countries, businesses are working to win deals by offering comprehensive solutions, which also include the long-term financing required by buyers.

According to the current estimate, the Finnvera Group's financial performance for 2013 is expected to improve over that for 2012. If realised, individual risks can have a considerably detrimental impact on performance.

CEO Pauli Heikkilä:

"Despite a certain degree of uncertainty, the general global economic situation is showing signs of a gradual recovery. Due to the industrial structure and a decline in competitiveness, the situation for Finland is not yet as promising. Although there has not been any growth in Finnish exports this year, the demand for Finnvera's export credit guarantees and credits has remained high, which is a result of tighter bank regulations.

Government preparations include several development projects concerning Finnvera’s services. These include the possibility of Finnvera to mark SME bonds, increase the authorisations for export credit guarantees and export credits, implement a refinancing guarantee and finance domestic investments made by major corporations. The decision regarding these will be made at the end of the year."

Additional information:

Pauli Heikkilä, CEO, tel. +358 29 460 2400

Ulla Hagman, Senior Vice President, Finances and IT, tel. +358 29 460 2458