Large corporates take calculated risks in export – A surprisingly high number of deals fall through

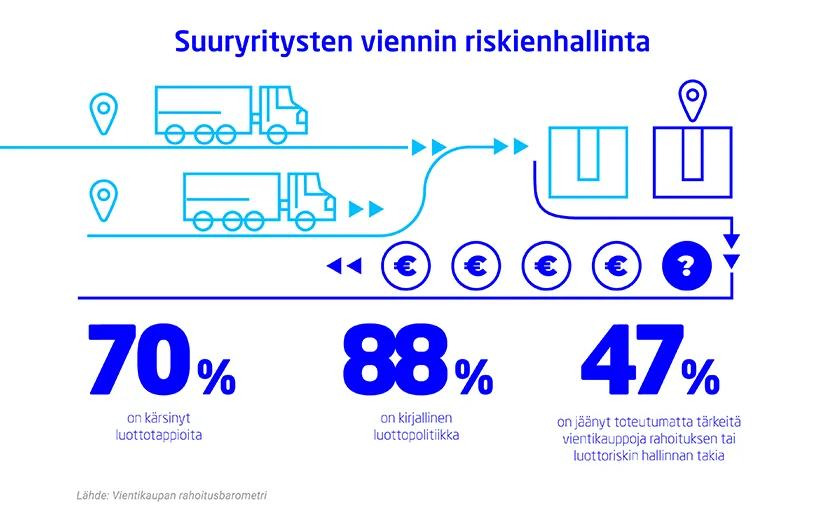

Seventy per cent of large corporates have suffered credit losses in export. In addition to the losses, half of the large export companies have lost important deals, despite the fact that they are fairly familiar with risk management and export financing work. This is indicated by the export financing barometer commissioned by Finnvera, Finland Chamber of Commerce and the International Chamber of Commerce, published in the summer.

Nearly all large corporates have a documented credit policy. The existence of such policy should automatically result in smaller credit losses, since the policy defines an acceptable risk level in export transactions. However, the end result is something different.

“Large corporates calculate the risk profiles of their clients carefully and carry out cost-benefit estimates on protection against risks. They continuously seek balance. The sales volume is so high that it is inevitable to also include partners that are just not suitable,” Jussi Haarasilta, Executive Vice President at Finnvera, says.

Tuukka Andersén, Finnvera’s Vice President, Head of Underwriting, also considers the credit losses of large corporates to be a conscious choice.

“The role of credit policy varies in different companies. In some, the policy may be very strict and dictate the terms of trade. On the other hand, a deal of a few hundreds of thousands of euros may be so tempting in terms of its business potential that companies are willing to take risks,” Andersén says.

According to a study, export transactions of companies average less than EUR 100,000. More than half of the export transactions of large corporates, too, amount to less than half a million euros.

Half of the deals fall through

Large corporates are reasonably well versed in the mechanisms of managing risks related to the buyer.

The best known of these mechanisms is advance payment. It is followed by letter of credit, Finnvera export credit guarantees, private credit insurance, and bank guarantee.

In spite of this, nearly half of the respondents state that their company has had important export transactions fall through due to reasons related to funding or the management of credit risk. Andersén considers this number to be surprisingly high.

“We have lots of solutions for funding export transactions. However, it should be kept in mind that we also assess the creditworthiness of the parties involved in relation to our own credit policy and use it as the basis of our decision to take the risk. The poor financial standing of the buyer may explain some of the cancelled deals,” Andersén says.

Regardless of the size of the export companies, advance payment is usually the first alternative in risk management. On the other hand, companies recognise that granting a payment period to the buyer is a significant competitive factor.

“The smaller the company, the weaker the knowledge of other protection mechanisms and methods of buyer financing,” Haarasilta says.

Documented credit policy for all companies

The losses generated by deals vary by sector and export country, since the payment morale varies by company. The median credit loss is 30,000 euros. However, a loss of tens of thousands hits a micro-enterprise with turnover of less than 2 million euros a lot harder than a large corporate with turnover exceeding 300 million euros.

Haarasilta and Andersén encourage smaller companies to define a written credit policy as well. The risks increase if there are no guidelines. One of the risk groups is companies with turnover in the range of 50–100 million euros. A third of these companies has not defined a credit policy.

“Large corporates have learned to manage risks. They are also otherwise more conservative than foreign competitors. They know their clients and take few risks in terms of establishing operations in new markets. That results in a smaller need for external risk management solutions, compared to companies in Central Europe, for example,” Andersén says.

Further information:

Jussi Haarasilta, Executive Vice President, Finnvera, tel. +358 029 460 2601

Tuukka Andersén, Vice President, Head of Underwriting, Finnvera, tel. +358 29 460 2688